Speakers on Saturday urged recently formed coalition government to design comprehensive economic reforms strategy amid taking corrective measures to rationalize taxation system of Pakistan.

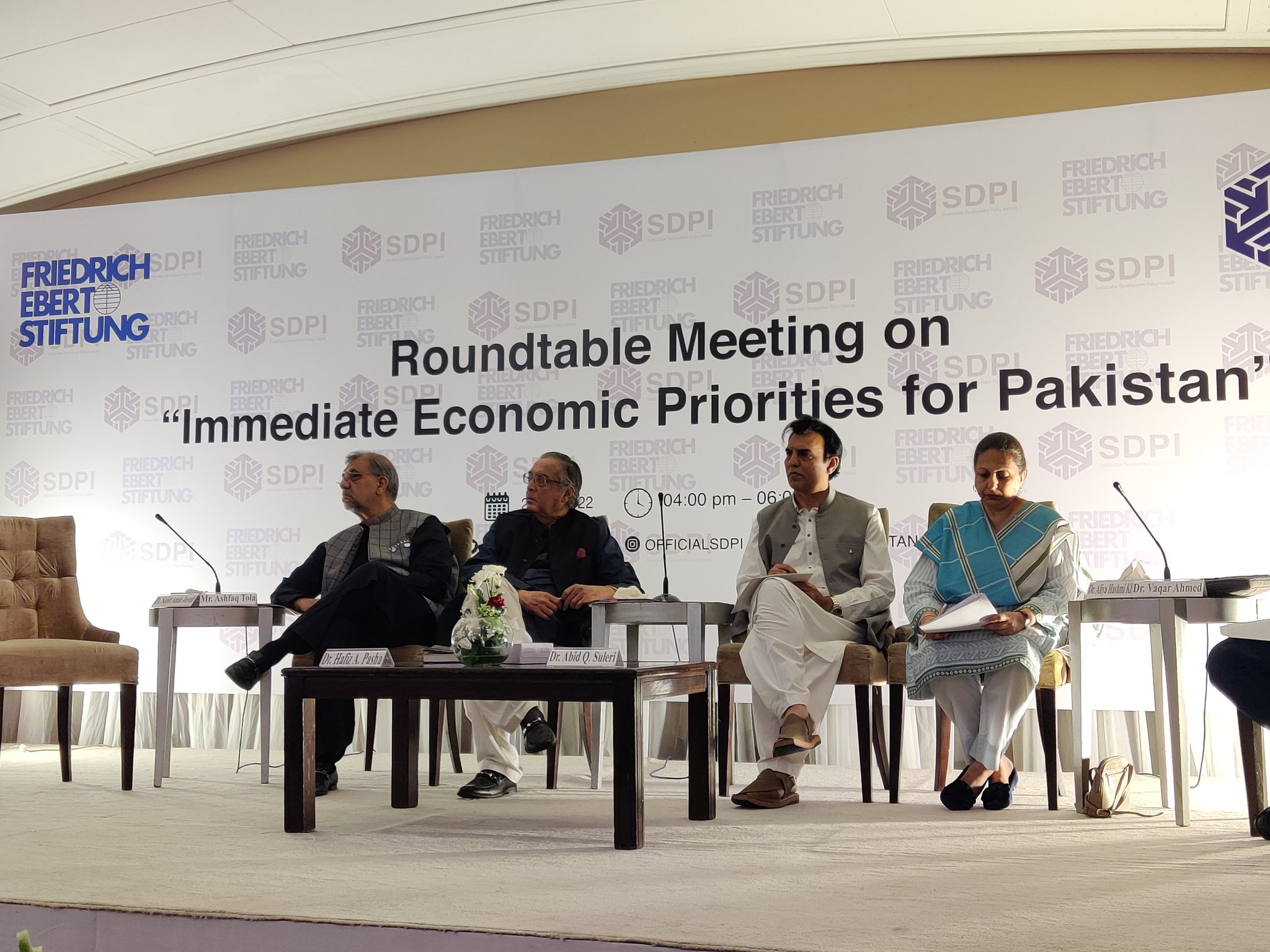

Dr Hafeez A Pasha, former finance minister Pakistan expressed during his keynote speech at the roundtable meeting on ‘Immediate economic priorities of Pakistan’ jointly organized by Sustainable Development Policy Institute (SDPI) and Friedrich Ebert Stiftung (FES) in Islamabad.

Dr Pasha was of the view the agenda of comprehensive economic reforms strategy should be the top most priority for the new coalition government. It is for the first time that we are having such a broad-based national consensus government and, thus, it needs to be taken as a golden opportunity to correct the economy and rationalize our taxation system.

After COVID-19, the Russian-Ukraine Crisis has again triggered global recession and the issue of food security crisis: Dr Abid Qaiyum Suleri

Dr Pasha highlighted that the current account deficit of Pakistan in the first 8 months of the current fiscal year has reached 12-billion-dollar and could touch 18 to 19 billion dollars by June 30, 2022. Thus, we would be needing 30 to 32 billion dollars of financing every year to manage our transactions with rest of the world.

Dr Pasha projected while adding that about 5.5 billion dollars decline in the foreign exchange reserves in the month of March 2022 has added further into our economic woes. He suggested that while entering the negotiations with the IMF, we should ensure the IMF that we are going to pursue a comprehensive reforms’ strategy. The relief package should be targeted while all indirect taxes on basic food items including ghee, sugar, spices, vegetables, and tea, should be withdrawn.

Circular debt of Pakistan is not just a governance issue but an accounting issue in power and gas sectors, Dr Vaqar Ahmed

Dr Pasha said, ‘long-term capital gains exemption should be withdrawn on property and shares while fuel adjustment charges should be removed only for the small consumers.” Besides, taxation should be on comprehensive income along with progressive taxation.

Dr Abid Qaiyum Suleri, Executive Director, SDPI, highlighted that after COVID-19, the Russian-Ukraine Crisis has again triggered global recession and the issue of food security crisis. He said, “the Issues that Pakistan is facing, especially pertaining to high inflation are linked with the global scenarion”. Dr Suleri highlighted that the political instability would still remain a threat to our economy. He suggested that the new government should try to strengthen social safety nets instead of unrealistic promises of reducing the inflation.

Renowned economist ICAP President Ashfaq Tola on the occasion asserted that to streamline the taxation system in Pakistan, we have to correct the fractured system of taxation. He said that the new government should take care of the inequity of taxes.

Senior economist Dr Aliya Hashmi was of the view that we need to look into the issues of Pakistan in a global perspective rather than a domestic one. Besides, we need fiscal consolidation as our budget financing requirements are now under new State Bank law which means the Government cannot borrow from the central bank and we have to rely on foreign financing.

Dr Vaqar Ahmed, Joint Executive Director, SDPI, highlighted that circular debt in both power as and gas sectors, is one of the key contributors to the fiscal seepages. “Nobody knows the true value or estimate of the circular debt in this country as the supply chain in the sector is broken,” Dr Ahmed said while adding further that it is not just a governance issue but also an accounting issue in the power and gas sectors.