While finding no plausible reason in the provincial government’s plea to delay the much awaited local body election in the province, the Balochistan High Court (BHC) on Wednesday directed the Election Commission to hold the same as per the announced schedule on May 29, 2022.

Two days ago on April 12, Awami National Party (ANP) leader Mabat Kaka invoked the jurisdiction of the BHC, seeking postponement of local bodies election schedule, issued by the Election Commission of Pakistan (ECP) for Balochistan, for six months.

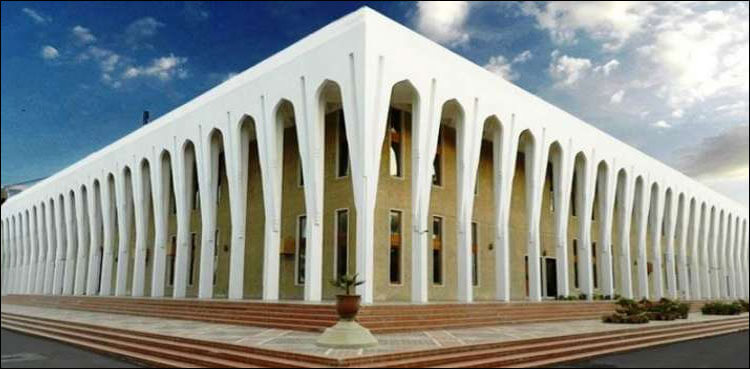

After preliminary hearing of the matter, a division bench comprising Chief Justice Naeem Akhtar Afghan and Justice Rozi Khan Barreach issued notices to the government of Balochistan and the Election Commission of Pakistan for Wednesday.

The bench issued an 11-page verdict in the matter, a copy of which is available with TLTP, after hearing parties of the case saying, “Currently there is no turmoil/ political disturbance in Balochistan. The province of Balochistan is also not facing any law & order situation, no reforms are required for local government elections.”

The division bench said in its verdict, “In view of preparedness of the Election Commission of Pakistan to conduct local government elections according to announced schedule, presently there is no impediment in conducting the Local Government Elections according to the schedule announced by the Election Commission of Pakistan vide Notification dated 30.03.2022”.

Appearing before the bench on Wednesday, the ECP counsel apprised the bench that currently neither there is any political turmoil nor there exists any law and order situation in the province of Balochistan to justfy further delay of the LG Polls saying the LG polls in the province will be held on the basis of electoral rolls of year 2020 which have already been verified and finalized.

Besides, the advocate general of the Balochistan urged the court to delay the LG polls on the grounds that the Balochistan government had to prepare budget for financial year 2022-2023 and to reschedule the election after June 2022,

However, the counsel for the ECP contended that previous LG polls 2013 were completed in 2015 and on completion of tenure of four years on January 27,2019. He submitted the next LG polls were to be conducted within 120 days under the Constitutional provisions.

He argued that the chief secretary of Balochistan is very much knowledgeable about the proposed schedule for conducting LG Polls after which the ECP has announced the schedule by issuing notification on March30, 2022. The ECP lawyer also informed that Council of Common Interests (CCI) during its 45th meeting on April 12 last year has approved the census of 2017.

The bench said in its verdict that electoral rolls have already been prepared and finalized. It added that all the delimitation petitions are likely to be decided by the Special Bench of the BHC before the date of filing the nomination papers by the candidates. It has also been stated in the verdict, “The ECP is capable to manage any changes, if ordered by the special bench of this court, subject to adjustment of relevant dates for relevant activities in the relevant wards/union councils without changing the polling date of May 20,2022″

The bench after dismissing the ANP and provincial government petition in the matter said in operative part of the verdict, “In view of preparedness of the ECP to conduct LG Polls according to the announced schedule, presently there is no impediment in conducting the Local Government Elections according to the schedule announced by the Election Commission of Pakistan vide Notification dated 30.03.2022”.