While invoking Islamabad High Court’s jurisdiction in order to get constitutional provision implemented in true letter and spirit for children welfare on Thursday, a pro-bono lawyer sought the court’s directives for the federal and provincial governments to launch a mid-day meals scheme for primary school children across the country on a priority basis.

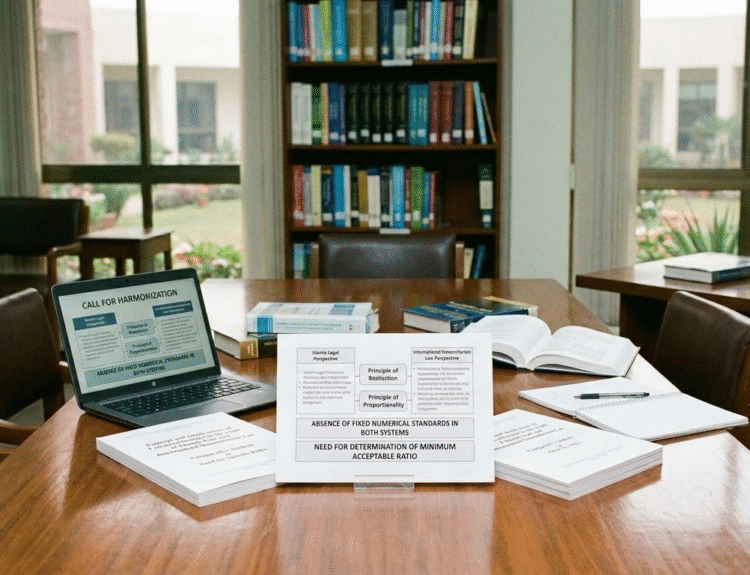

Making the federation and all the provincial governments as respondents, Advocate Akram Chaudhry referred fact sheet of UN World Food Program that recorded undernutrition and food insecurity among 20 percent people of Pakistan whereas a total of 45 percent of children younger than five years of age were stunted.

Seeking the court’s directives for the federal and provincial governments in the matter, he submitted that launching Mid-Day Meals Scheme across the country for primary school students is primary responsibility of the government in preview of the Article 39 (a) of the Constitution which underscores dire need for promotion of social and economic well-being of the citizens without any discrimination.

Substantiating his claim the petitioner Advocate Akram Chaudhry cited Indian Supreme Court verdict of November 28, 2001, saying as a result of the Indian top court verdict in the matter, currently more than 120 million primary school children were being provided with a prepared midday meal with a minimum content of 300 calories and 8-12 grams of protein each day of school.

The petitioner prayed the court to direct the federal and provincial governments to provide cooked mid-day meals provision to primary schools students as well as ensure continuity of the process.