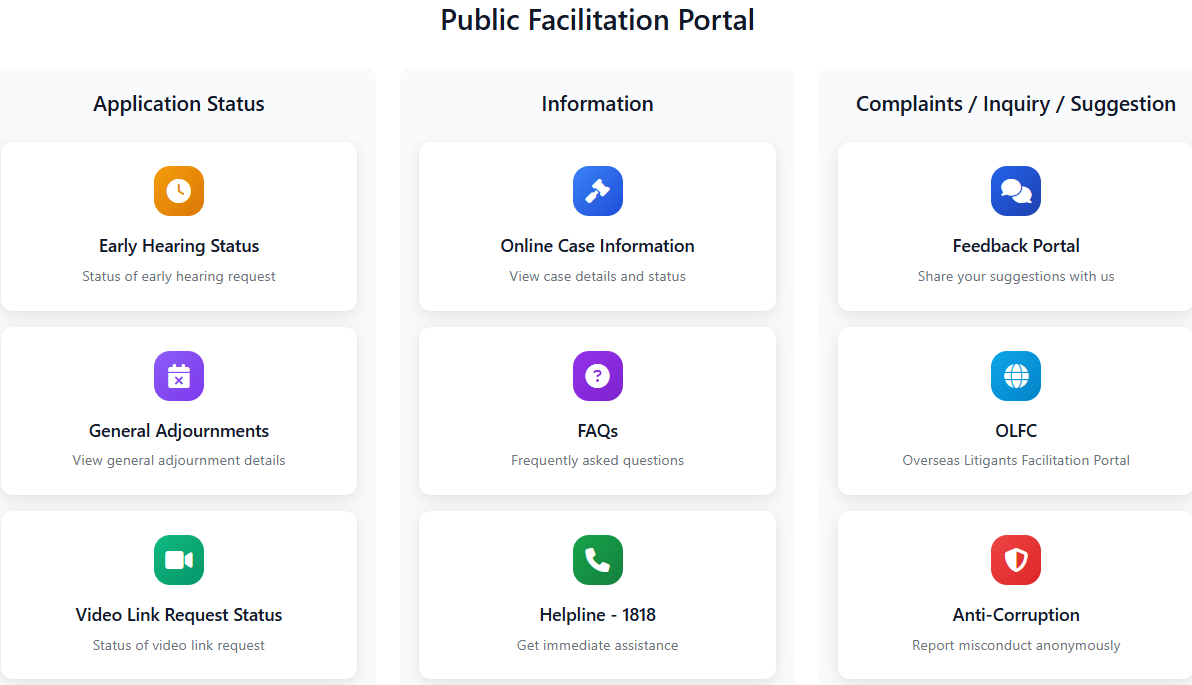

ISLAMABAD – Taking a significant step toward judicial accessibility, the Supreme Court of Pakistan has launched its new Public Facilitation Portal, which is now live on the Court’s official website under the ‘Public Portal’ link. Developed under the special directions of the Chief Justice of Pakistan, the interactive online gateway bridges the gap between citizens and the judiciary.

The initiative aims to bridge the gap between citizens and the judiciary, simplifying access to justice for every individual regardless of their location, background, or profession. This digital transformation moves the Supreme Court from a formal, distant entity to an approachable and responsive service platform.

Key Features Enhancing Transparency and Ease of Use

The portal is a comprehensive tool featuring several modules designed to streamline judicial interaction:

- Cases Information: Users can conveniently search for case details by name, case number, or petition type, a service that previously often required in-person visits. The section also includes a Helpline 1818 for real-time guidance, technical support, and resolution of procedural queries. Furthermore, a detailed Frequently Asked Questions (FAQs) section explains complex judicial terms and procedures in plain language, empowering citizens without legal representation.

- Applications Status: This module provides a seamless digital mechanism for the real-time monitoring of key applications, including Early Hearing Requests, General Adjournments, and Video Link Petitions. Litigants can track their requests from submission to decision, which significantly reduces the need for follow-up visits and written correspondence, ultimately cutting down on administrative delays. Critically, this feature ensures that overseas Pakistanis and those from remote regions can stay fully connected with their case progress without physical presence.

- Complaints and Enquiries & Accountability: This cornerstone of institutional accountability includes a Feedback Portal for users to register grievances, submit feedback, or share improvement suggestions. The Anti-Corruption Reporting mechanism offers a confidential channel for the public to report unethical practices, reinforcing the SCP’s zero-tolerance stance against misconduct.

- Overseas Litigants Portal: Extending judicial facilitation globally, this specific portal enables Pakistani nationals living abroad to securely communicate with the Court, monitor their cases, and lodge requests.

A New Era of Openness

The launch of the Public Facilitation Portal marks a new era of openness and accessibility in Pakistan’s justice system. By putting court services at every citizen’s fingertip, the Supreme Court is realizing its vision of justice without barriers, ensuring that the process is not only delivered but is also visible, understandable, and reachable.

The initiative, which exemplifies a responsive, transparent, and people-driven judiciary, ensures that the voice of every citizen is heard and respected within the framework of justice, stated in a press release.