Categories

Courts

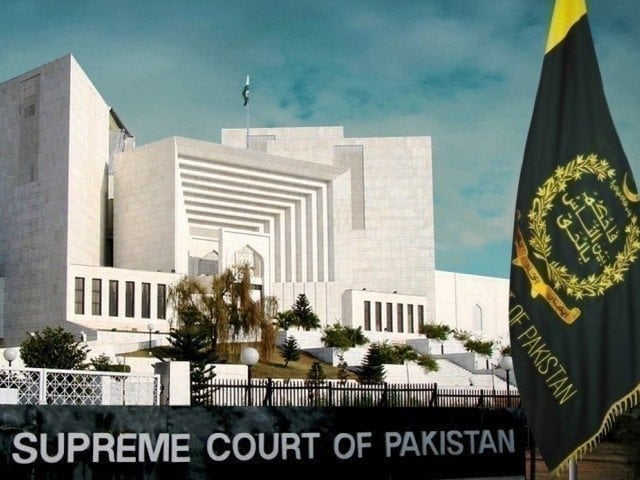

Govt to Appeal SC to Lift IHC Stay on 15% Additional Income Tax from Bank

A week ago the IHC barred FBR from taking any coercive action against the commercial bank based on calculations made under Rule 6C (6A) of the seventh schedule of the ITO

Read More