Sindh High Court extended interim stay order with regard to the Oil and Gas Regulatory Authority’s notification on sale price of gas for textile manufacturers and other industries subject to depositing of differential amount before the Nazir of the court.

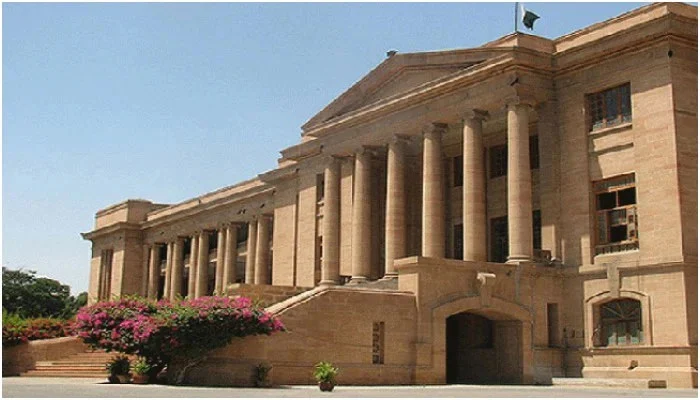

A single-member bench of Justice Mahmood A Khan of the Sindh High Court (SHC) on Thursday resumed hearing of the pleas of textile manufacturers and other industries utilizing natural gas as industrial consumer supplied by the Sui Southern Gas Company (SSGC) in the matter. The court also turned down the federal government’s request for depositing differential amount before the federal government instead of Nazir of the court.

Counsel for petitioners submitted that the Ogra notification issued on November 8, 2023 and December 14, 2023 were issued in contravention of Section 8 of the Ogra Ordinance read with Rule 18 of the national gas tariff rules 2002 whereby sale price has been exorbitantly increased.

The counsel argued saying the SSGC was issuing gas bills on basis of impugned notification. They said that action taken by the caretaker government in respect of fixation of exorbitant sale price was also in violation of powers under Section 230 of Election Act 2017. They sought an interim order with respect to the impugned notification to the extent of plaintiffs and further for suspension of any increased sale price as reflected in gas bills issued to them.

The federal law officer submitted that the caretaker federal government increased the gas prices to increase the revenue on the conditions fixed by the IMF. The court inquired the law officer as to where the agreement between the IMF and the government was and the document relied by the law officer was not an agreement but a press release, which asked the government to raise revenue and the increase in gas prices was the government’s own proposal. The federal law officer submitted that plaintiffs were part of consultation process with regard to increase in gas prices and were aware of the situation. He said the court has lack of jurisdiction to decide on policy matters.

The court directed Ogra, SSGC and others to file comments on the petitions by March 14 and granted the interim order on sale price of gas for textile manufacturers and other export industries subject to depositing differential amount before the Nazir of the court.