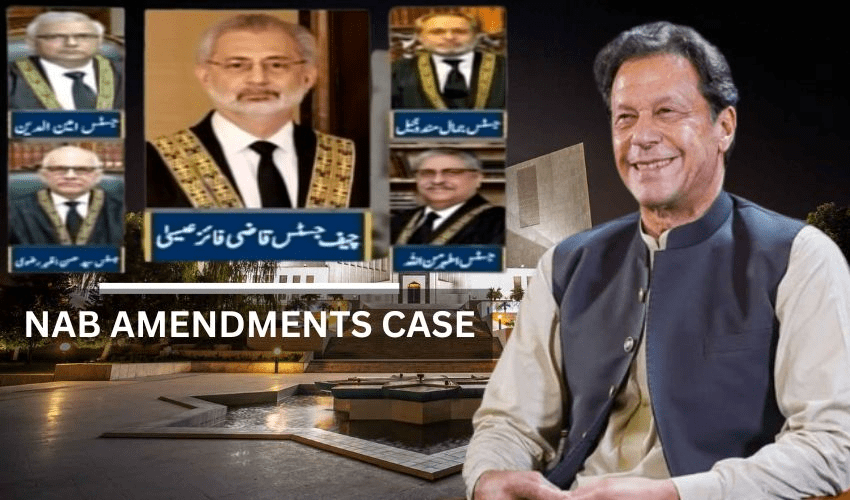

Pakistan Tehreek-e-Insaf (PTI) founder Imran Khan appeared before court in intra-court appeal against the Supreme Court’s decision regarding the National Accountability Bureau (NAB) amendments, one of the main parties in the case, appearing from Adiala Jail through a video link.

A five-member larger bench of the Supreme Court, headed by Chief Justice of Pakistan Qazi Faez Isa, heard the case. Unlike many previous proceedings in significant cases, Thursday’s hearing was not aired live on TV and social media channels.

NAB amendment case:

On October 17th of the previous year, the federal government took an important step by filing an appeal against the decision that nullified the amendments made to the NAB (National Accountability Bureau) Act. The appeal sought to reverse the ruling that declared the NAB amendments void.

The appeal named several parties, including the federation, NAB, and the Chairman of the Pakistan Tehreek-e-Insaf (PTI). This legal action came in response to the decision handed down regarding the NAB amendments.

Adding to the legal complexity, petitioner Zubair Ahmed Siddiqui filed an appeal against the decision on the NAB amendments under the Practice and Procedure Law. Siddiqui’s appeal aimed to challenge the ruling and urged for the reinstatement of the amendments nullified by the court.

Imran Khan Challenges NAB Amendments:

The amendments to the NAB Act were challenged by the founder of Pakistan Tehreek-e-Insaf, Imran Khan, during the tenure of the former Prime Minister Shehbaz Sharif in 2022. The matter was heard by a bench led by former Chief Justice Umar Atta Bandial.

NAB Amendments: A Brief Overview

The NAB Amendment Bill 2022 aimed to limit NAB’s powers, removing several matters from its jurisdiction, including corruption cases involving less than Rs 50 crore. The bill also withdrew the President’s authority to appoint Accountability Court judges and extended the tenure of the Prosecutor General NAB by three years.

PDM govt amend NAB law:

The PDM government introduced 27 amendments to the NAB Act in May 2022, which were passed by the National Assembly and Senate. However, former President Arif Alvi declined to sign the bill, leading to a joint session of the National Assembly and Senate in June 2022, where the amendments were approved.

Key changes included:

Limiting NAB’s jurisdiction over certain matters

Exempting corruption cases involving less than Rs 50 crore from NAB’s investigation

Transferring the President’s authority to appoint Accountability Court judges to the federal government

Extending the Prosecutor General NAB’s tenure by up to three years

Allowing cases to be tried in the Accountability Court of the same area where the offense was committed

Withdrawal of NAB’s power to supervise with the help of the High Court

Excluding federal, provincial, and local tax matters from NAB’s purview

Preventing other government agencies from assisting in investigations

Requiring the accused to be informed of charges against them

Extending the maximum remand period from 14 to 30 days

Unraveling the NAB Amendments Case: A Comprehensive Guide