ISLAMABAD – A writ petition seeking enforcement of the rights of persons with disabilities under the ICT Rights of Persons with Disabilities Act, 2020 in ture letter and siprit, is currently pending before the Islamabad High Court (IHC). Earlier, Justice Ameen Minhas was hearing the matter on September 9, 2025, addresses several crucial issues concerning accessibility and inclusion.

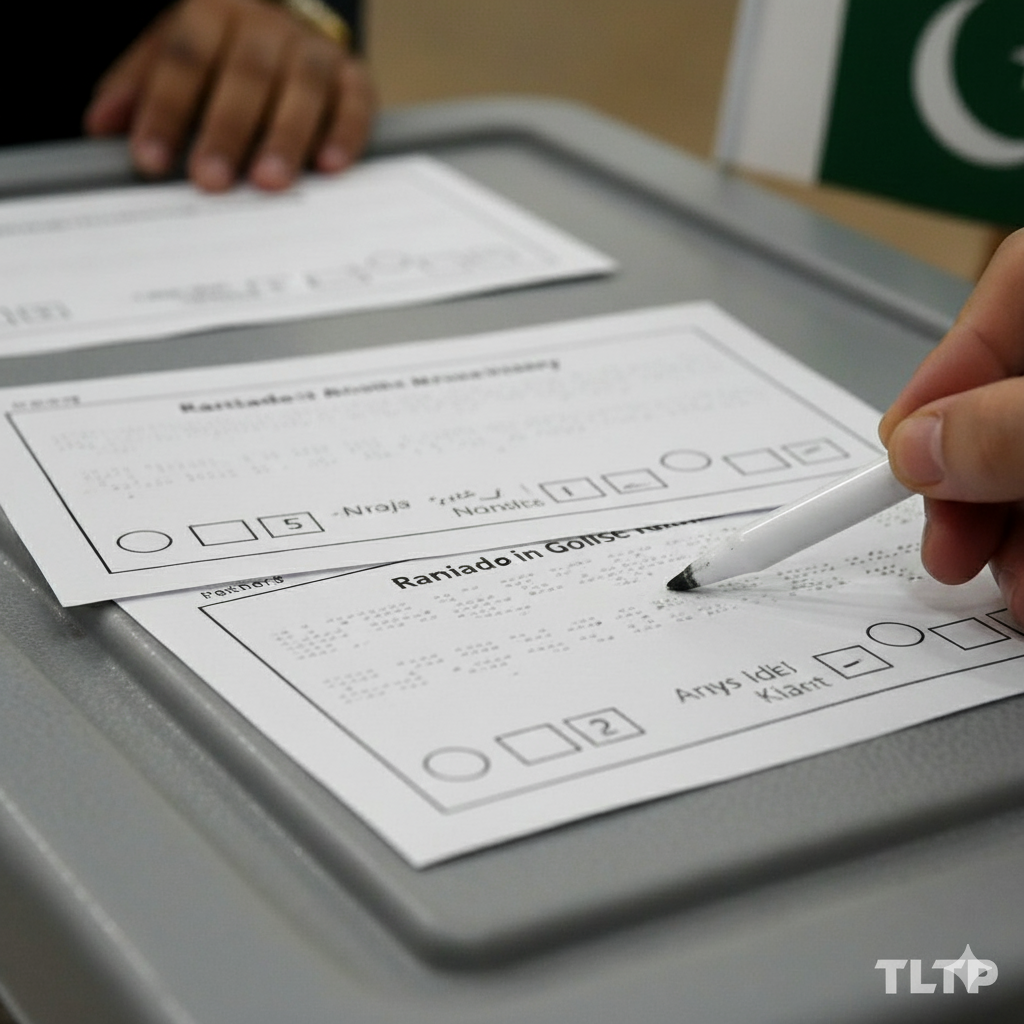

Syed Shahbaz Shah Advocate High Court has filed the petition while seeking a range of remedies in order to ensure rights of persons with disabilities . The petiitoner has urged the court to consider his plea for accessible voting saying a primary request is for the Election Commission of Pakistan (ECP) to provide Braille ballot papers or other accessible voting mechanisms for blind and low-vision voters. The ECP has reportedly expressed reservations, citing the need for amendments to the Elections Act, 2017. However, the petitioner argues that the ICT Rights of Persons with Disabilities Act, 2020, already mandates the ECP to ensure accessibility. The petitioner also sought directives for the provision of free education, including higher education, health insurance, and effective access to employment for persons with disabilties.

- 1win

- pin up

- mostbet

- pin up

- 4rabet mirror

- mostbet

- 1 win

- mostbet casino

- pinap

- пин-ап

- mosbet casino

- mostbet

- 1 win bet

- 1vın aviator

- пинап

- pinco slot

- pinco casino

- 1win casino

- mostbet kz

- pin up casino uz

- luck jet

- mostbet kz

- pinup casino

- 1 win casino

- mostbet casino

- pin up casino

- pin up casino uz

- mostbet uz casino

- 4x bet

- pin up casino

- mostbet

- game aviator

- mosbet

Shahbaz Shah described employment quota saying another key demand is the strict implementation of the statutory disability employment quota in both public and private sectors, with the provision of reasonable accommodations for employees with disabilities. Besides, he was of the view that the Ministry of Human Rights has established the ICT Council on the Rights of Persons with Disabilities, which is responsible for overseeing the implementation of the Act. The matter is pending further directives from the court.